Much more than a POS terminal¹

The new generation of POS is here

A next-generation tool with dual Wi-Fi connectivity and 4G

Install free apps from the Sabadell Store

Manage your day-to-day payment collections more easily and quickly

Receive all sales receipts on closing by e-mail

And revolutionise your business with tailored solutions

What does it let you do?

Send the receipt via e-mail, WhatsApp or QR code

Conduct satisfaction feedback surveys

Include personalised promotions on the receipt

Offer the rounding donation to charitable causes

Manage payments in foreign currency, with a 0.50% discount

Smart POS makes all the difference

1. Return: 0% Nominal Interest Rate (NIR), 0% Annual Percentage Rate (APR). The conditions of the Sabadell Business Plus Account will apply if you meet the sole requirement of signing up for your first Dataphone POS terminal or Smart POS terminal or Smart Mini POS terminal. Exclusive conditions for customers without a POS terminal prior to 13 May 2024. The foregoing conditions of the Sabadell Business Plus Account will be maintained as long as the POS terminal term is complied with, which will be reviewed on a monthly basis. If this requirement is not met, the Sabadell Business Plus Account will now automatically only require a minimum monthly deposit of €3,000 (excluding deposits from accounts opened in the Banco Sabadell group in the name of the same account holder). This requirement must be met on a monthly basis, and if it is not met for two consecutive months, the Sabadell Business Plus Account will automatically become a Relación Account.

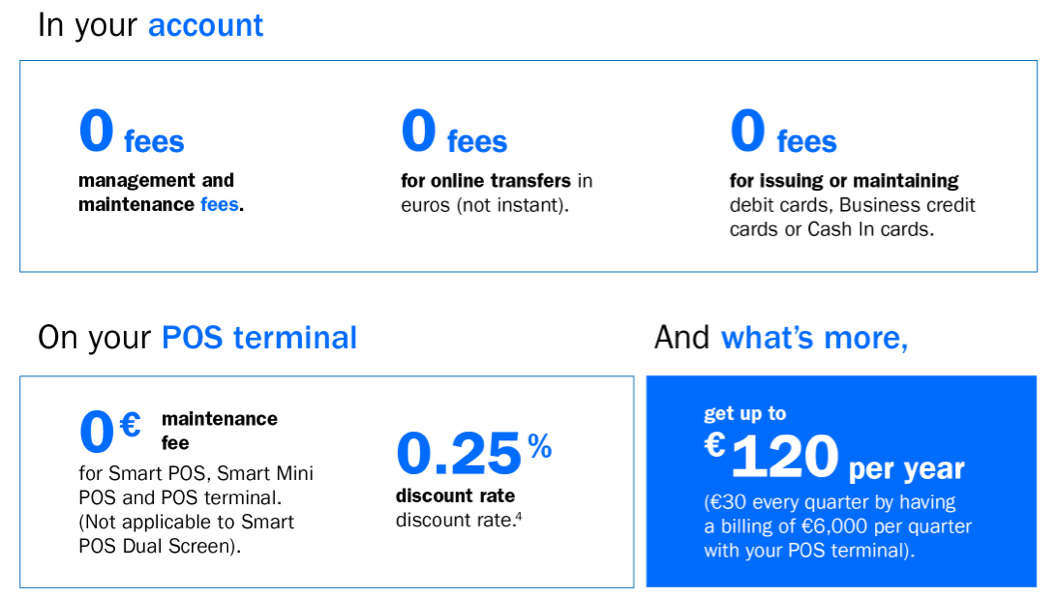

2. No account management or maintenance fees. Indefinite profitability that may change depending on market conditions. From now on, a 2% APR return per annum up to an average combined balance of €20,000 from the Sabadell Online Account and the Sabadell Savings Accounts. Representative example of total remuneration in one year calculated for a joint average monthly balance of €20,000: 2% NIR per annum, 2.018% APR, €400 in interest settled in the year. Settlement is paid on a monthly basis and is credited to the Sabadell Online Account on the 15th day of the following month (or the first working day before it).

3. Promotion open to all customers in the HORECA sector (Hotels, Restaurants and Cafés) that are holders of a Sabadell Business Plus Account and Sabadell Online Account for business use, who contract a Smart POS, Smart Mini POS terminal or POS terminal, who haven’t previously had a Banco Sabadell POS, between 13 May and 31 August. The promotion will consist of:

- €0 monthly maintenance fee on your first Smart POS terminal, Smart Mini POS terminal or POS credit card terminal.

- Sabadell Business Plus Account with no access requirements.

- Get €30 gross cashback every quarter if the account holder has a turnover of at least €6,000/quarter with any POS model contracted with the bank, up to a maximum payment of €120 gross per annum.

For the quarter between April and June, the minimum turnover to be able to qualify for the promotion is €2,000. For subsequent quarters, the minimum will be €6,000. For all quarters, the cashback amount will be €30 gross.

The offer is extendable to the Double Screen POS, with the exception of the maintenance fee, which for this terminal will be €18/month with the Sabadell Negocios Plus Account. The monthly fee for the maintenance of the POS will increase according to the corresponding VAT or indirect tax, in accordance with the criteria established by the Tax Administration.

4. The per-transaction fee of 0.25% will be applied directly for all personal cards issued in Spain with a minimum of €0.02 per transaction. European Personal cards will be charged a fee of 0.40%, with a minimum of €0.07. Domestic business cards will be charged a transaction fee of 0.80% with a minimum of €0.07 per transaction. Cards for European businesses, non-European cards (personal and business) and JCB and CUP cards have a transaction fee of 1.80% + €0.39, with a minimum of €0.46 per transaction. Mastercard B2B cards under the GWTTP programme incur a transaction fee of 2.95%. Transactions made with American Express cards are excluded from this offer and are subject to specific fees.